Bumper Sticker Economics

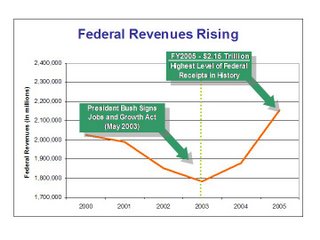

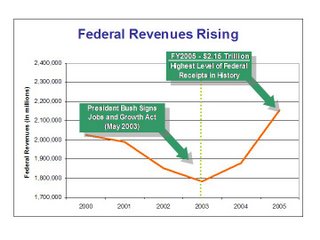

Dave at First State Politics, who has developed a fixation on the Laffer Curve, reprinted this graphic with the comment:

Actually, the chart says very little. It has six data points with two dates superimposed, to give the impression that a single event in 2003 can be considered the cause of the revenue number in 2005.

Actually, the chart says very little. It has six data points with two dates superimposed, to give the impression that a single event in 2003 can be considered the cause of the revenue number in 2005.

A more instructive chart might include a second set of data points for expenditures, which would then (inconveniently) yield the record deficits racked up under President Bush.

For those interested in something a little more sophisticated than bumper sticker economics, try the site Economist's View, which today features a critique of what is referred to as "dynamic scoring," in which revenue projections are goosed upwards to include the magical restorative effects of tax cuts:

Or if you prefer the bumper sticker version, try this comment from fellow blogger Stygius:

This chart from the Treasury Department says it all:

Actually, the chart says very little. It has six data points with two dates superimposed, to give the impression that a single event in 2003 can be considered the cause of the revenue number in 2005.

Actually, the chart says very little. It has six data points with two dates superimposed, to give the impression that a single event in 2003 can be considered the cause of the revenue number in 2005.A more instructive chart might include a second set of data points for expenditures, which would then (inconveniently) yield the record deficits racked up under President Bush.

For those interested in something a little more sophisticated than bumper sticker economics, try the site Economist's View, which today features a critique of what is referred to as "dynamic scoring," in which revenue projections are goosed upwards to include the magical restorative effects of tax cuts:

Tax cuts do not pay for themselves. Economists of all stripes have consistently found that tax cuts do not generate enough growth to fully pay for themselves. In fact, cost estimates that incorporate macroeconomic feedback from tax cuts are reasonably close to conventional cost estimates that ignore such feedback. ... The Administration’s own estimates published in the Mid-Session Review indicate that, even with favorable assumptions, dynamic feedback would pay for less than 10 percent of the cost of making the tax cuts permanent.For those who wish to understand the effects of tax cuts on revenues, I recommend this Congressional Budget Office report with the ungainly title, Analyzing the Economic and Budgetary Effects of a 10 Percent Cut in Income Tax Rates.

Or if you prefer the bumper sticker version, try this comment from fellow blogger Stygius:

Deficit spending increases the deficit. There.

14 Comments:

Hey, Tom. Thanks for visiting the site.

I will give you this: the chart was an administration chart, which told you what they wanted you to know.

I will take exception to a few points you make:

#1 - The issue here is revenue, not expenditures or the deficit. The main question is this -- Is this revenue growth evidence that supply-side tax cuts work?

#2 - revenue projections are goosed upwards to include the magical restorative effects of tax cuts:

It's not necessary to talk about projections when we have actual data for most of '04,'05 and most of '06. I agree that revenue projections have become very hard to make given the volatility.

I would disagree also with the fact that tax cuts, or more specifically tax rates, do not justify themselves. The GDP growth we've seen since the tax cuts has been consistently in the 4% range. Productivity is up, overall compensation is rising faster in the 00's than it did in the 90's, unemployment is below "full employment", and the budget deficit will be at around 2.3% of GDP, lower than 17 of the last 25 years according to the WSJ.

Also, look at the relationship between tax rates and GDP growth in, say, Sweden vs. Hong Kong.

Unless someone can give me some solid evidence that tax cuts didn't cause this eruption in positive economic data, I'm going to stay with my opinion.

Again, thanks for visiting. Please come again.

What you regard as "positive economic data" is pretty suspect.

For example, overall compensation is rising faster in the 00's than it did in the 90's. Sure, some top earners are raking it in, but most people have not had a raise (when you consider inflation) for years.

If your point is that the economy is good for rich people, I agree. If your point is that the economy is good. I disagree.

I will give you this: the chart was an administration chart, which told you what they wanted you to know.

This is the definition of propaganda. The chart is a disservice to the taxpayer.

Unless someone can give me some solid evidence that tax cuts didn't cause this eruption in positive economic data

There is no eruption; that is the essential trickery of the chart. You have been fooled because you lack sufficient scope of knowledge.

What the chart shows is a return to the historical mean from the massive declines CAUSED by the Bush tax cuts.

The chart shows at best that taxes for the rich can be cut without significant declines in long-term revenue. But if that revenue is now being fed by the deficit, there is no net gain and the chart is fraudulent since it does not note debt.

The long-term historical charts show that revenue keeps going up more or less regardless of policy. Significant events like the Reagan tax cuts in 1986, the Clinton expansion, or the Bush tax cuts do create sharp disruptions in the graph over the short term. But the growth always reverts to the mean.

Here's a good long-term chart for revenue growth from MarkTaw.com (lots of good stuff there). Look at where the blue line pokes sharply over the green line - that's the Clinton boom. Bush took us sharply off that line and only now has brought us back to the mean.

Oops. sorry, I messed up the link to MarkTaw.com

You can insult me all you like, but I'm still looking for an answer to my question:

What caused the revenue spike, the low unemployment, the compensation growth and the regular 4% GDP growth?

And Jason, you are talking about wages only, not overall compensation.

What caused the revenue spike

There is no revenue "spike." That's an artifact of your phony graph. Look at the long-term graphs and see where the spikes really are (both up and down).

the low unemployment, the compensation growth and the regular 4% GDP growth?

Keynesian stimulus created by deficit spending.

Some call this a Laffer Curve, I prefer to call it the Laughable Curve. Let's not make the tax cuts for the wealthy permanent and let's agree to stop the deficit spending.

Actually the Laffer principle is correct. The principle is:

- If you tax at 0%, you obviously get zero revenue.

- And if you tax at 100%, nobody would work and you also get zero revenue.

- Somewhere in the middle there is an optimum tax rate that provides the most revenue with the lowest possible tax rate.

The problem is that to take advantage of this "lowest optimal" tax rate, you have to constantly re-evaluate economic conditions. Some years you can cut taxes, but other years you have to raise taxes to stay at the optimum level.

Unfortunately, Republicans have treated the Laffer principle as a ratchet: always lower taxes, never increase them. This even when they have implemented other policies that clearly call for increased taxation (war, for example).

After you set your tax rate to optimize revenue, then you have to ask yoursef "Is revenue optimization the goal, or are their other moral or social goals we can achieve through tax policy?" There you can find grounds for debate.

But the "real" deficit will be lower than 17 of the last 25 years, according to the WSJ. What of that?

stop the deficit spending...Keynesian stimulus created by deficit spending.

While I agree that this decade has been atrocious as far as spending is concerned, "real" spending has been lower than it was from 1975 to 1996. Also, the simple fact is the deficit is about to explode due to Social Security and Medicare.

According to the % of GDP chart, spending from 92-96 was higher than the 2000s.

Also, economic conditions are very different in the 2000s vs. the 1990s. The tech crash and September 11th each had an enormous impact on the economy and some stimulus was necessary to convince people to take risks again.

You seem to believe that revenue is OK, now all we have to do is cut spending. But you cannot decouple the current revenue from the deficit. The deficit is driving the revenue. If you cut the spending you lose the revenue. That's a structural problem in the Bush economy.

the simple fact is the deficit is about to explode due to Social Security and Medicare.

No, the deficit is about to explode due to lack of political will to properly fund Social Security and Medicare.

According to the % of GDP chart, spending from 92-96 was higher than the 2000s.

This is what Clinton termed "investment." Clinton provided new funding for education, law enforcement, worker training, etc. After 1996 the investments paid off with a healthy decline in spending (% of GDP), broad prosperity, and a balanced budget.

I will throw conservatives a bone here: The Clinton boom would not have occurred without the generally lower tax environment inherited from Reagan. In the early 90s the Reagan debt and lingering deficits were beginning to damage the economy, so economic conditions dictated a tax increase. Reagan's tax cuts gave Clinton the room he needed to slightly increase taxes on investments, which based on the resulting boom, were clearly too low and below the optimum for conditions.

Also, the Clinton boom might never have occurred if the Cold War was still continuing. Clinton takes hits for slowing defense spending, but that was exactly what was needed to reap the benefits of the peace dividend and put the money into productive private use - which is exactly what happened.

Thanks everyone for the great comments, ranging from wonky to snarky and back again. I seem to have hit a nerve.

Based on the volume of verbiage, I can safely conclude that the chart doesn't say it all.

There's enough material here for a week's worth of posts, which means I've got to get busy.

You asked for it. In the coming week look for posts on the federal deficit, income inequality and of course whether tax cuts pay for themselves. It should be fun.

Jason, Is it better to vote for a crooked, conservative Democrat than a honest, progressive Republican?"

You seem to believe that revenue is OK, now all we have to do is cut spending. But you cannot decouple the current revenue from the deficit. The deficit is driving the revenue. If you cut the spending you lose the revenue. That's a structural problem in the Bush economy.

That is certainly an opinion tha some people have, but aren't we talking about discretionary spending, really?

Wouldn't entitlement reform cut spending without affecting discretionary spending? Aren't there cuts that would not affect the stimulus you claim, or is it just spending more than you take in?

Wouldn't entitlement reform cut spending without affecting discretionary spending?

Depends what you mean by "entitlement reform."

If by reform you mean raise the FICA wage cap to fund the system, that would be a minor increase in taxes on the rich, but on the other hand all those retirees would be spending that money and I would expect that to lend support to the economy.

If by reform you mean yank benefits from retirees, then they would not be spending that money in the economy and I would not expect any stimulating effect.

If by reform you mean "use employee FICA contributions to buy magic beans, in the hopes of even greater returns," that's just silly.

Aren't there cuts that would not affect the stimulus you claim, or is it just spending more than you take in?

It's just total spending. All the money spent by the govt goes to somebody in the economy somewhere.

Don't get hung up on entitlements. The three biggies of expenses (I forgot the order) are:

Defense

Social Sec/Medicare/Medicaid

Interest on the national debt

Now, of those three, I'd say the most useless, and most eligible to be cut, is first of all the interest on the debt. Note that paying down the debt has its own benefits beyond just eliminating debt service - it would permitslower interest rates overall.

After that, the Iraq portion of the defense budget should be cut.

As for entitlements, why would anyone want to cut benefits on the sick and elderly before you have addressed those first two cuts?

Post a Comment

<< Home